What is the Series 3?

The Series 3 is an exam, also known as the National Commodities Futures Examination, administered by the Financial Industry Regulatory Authority (FINRA) on behalf of the National Futures Association (NFA). Candidates who pass the exam are eligible to register with the NFA and sell commodity futures contracts and options on commodity futures contracts.

ONLINE INTERACTIVE SERIES 3 COURSE

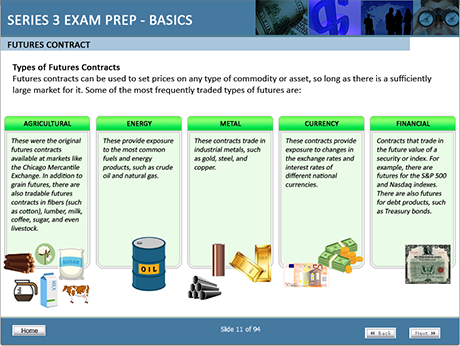

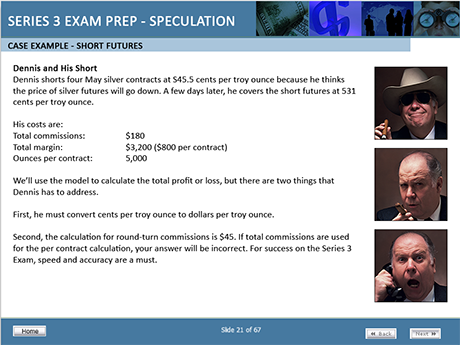

Pass the series 3 exam in the USA with this self-paced online course includes 11 narrated modules. Each module contains Knowledge Checks, real life examples and a Quick Quiz at the end of the module. You can get an idea of the look and feel and how the training is presented from the random screenshots below.

11 MODULES

- BASICS

- REGULATIONS

- PRICING

- ORDERS

- MARGIN

- SPECULATION

- SPREADS

- HEDGING

- OPTIONS

- INDEX FUTURES

- INTERACTIVE SCENARIO

- 100 SERIES 3 EXAM PRACTICE QUESTIONS & DETAILED ANSWERS

SERIES 3 EXAM STUDY MATERIALS

ESP COURSE WORKBOOK

This workbook contains all of the modules in the ESP online Series 3 course. You can purchase the workbook as a digital download.

200 SERIES 3 EXAM PRACTICE QUESTIONS & ANSWERS

Use this ESP Series 3 Practice Questions & Answers to study for the Series 3 exam. Includes 200 practice questions and detailed answers. You can purchase this as a digital download.

SERIES 3 EXAM ONLINE COURSE

- BASICS

- REGULATIONS

- PRICING

- ORDERS

- MARGIN

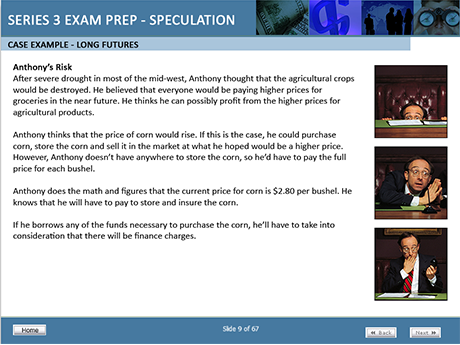

- SPECULATION

- SPREADS

- HEDGING

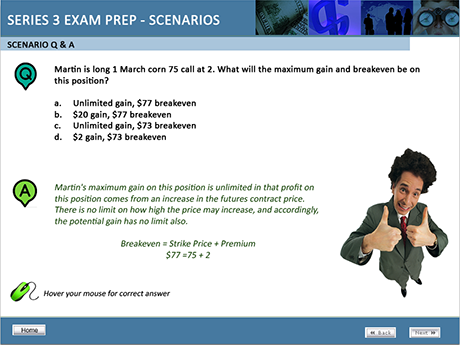

- OPTIONS

- INDEX FUTURES

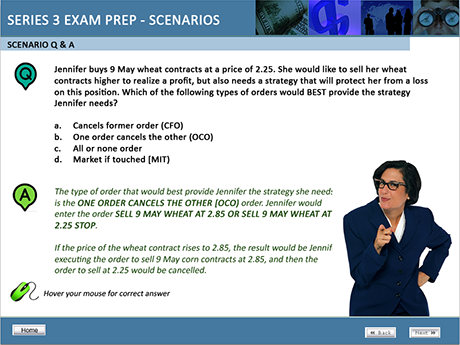

- INTERACTIVE SCENARIOS

- 100 EXAM PRACTICE QUESTIONS

- AUDIO INCLUDED FOR ALL TOPICS

$199

TRY OUR FREE EXAM PRACTICE QUESTIONS

Click the Start button below to start practice test. The test will open in another window. This practice test has 10 questions. You can take the test as many times as you want.

WATCH OUR COURSE DEMOS

Futures

Commodity futures and commodity forward contracts are functionally similar. The major difference is that futures are traded on regulated exchanges and have standardized contract terms. Forwards instead trade over-the-counter (OTC) and have customizable terms . . .

Speculation

After severe drought in most of the mid-west, Anthony thought that the agricultural crops would be destroyed. He believed that everyone would be paying higher prices for groceries in the near future. He thinks he can possibly profit from the higher prices for agricultural products . . .

PURCHASE COURSE NOW

This interactive online course includes 11 narrated modules. Each module contains Knowledge Checks, real life examples and a Quick Quiz at the end of the module.

SUBSCRIBE SERIES 3 EXAM NEWSLETTER!